Visa and HST Partner to Provide Innovative Payment Solutions in Latin America and the Caribbean

Miami, July 25, 2019 - Visa Inc. (NYSE: V) and HST Software Solutions announced today that they are working together to co-develop innovative solutions that benefit financial institutions and retailers across the region.The companies are collaborating to create mobile payment solutions and generate custom digital payment experiences, like mobile wallets. These innovative solutions are integrated with Visa’s application program interfaces (APIs) providing user-enhancing value added features. The partnership further expands Visa and HST’s longstanding relationship of collaboration.

“Collaboration is key to Visa’s innovation strategy, and we actively seek strong strategic partners to provide the best-in-class solutions, accelerating the adoption of new payment solutions everywhere we operate,” said Allen Cueli, Vice President, Solutions Architects for Visa Latin America and the Caribbean. “HST is a digital leader in Latin America and we are joining forces, combining their capabilities with those of our clients and Visa’s APIs to deliver new payment experiences, while making lives easier for consumers as we take another step towards digital transformation of the region.”

Visa Developer Platform (VDP)

Visa’s commitment to collaboration takes place in part, on the Visa Developer Platform, which makes many of Visa’s capabilities available as APIs. From funds transfer to transaction controls to travel solutions, VDP offers direct access to a growing number of APIs, tools, and support that can help make building and powering commerce easier, faster and more secure.

"Visa Developer Platform provided the perfect platform to integrate with our white label digital wallet solution, enabling us to provide an enhanced product for our customers,” said Eduardo Cunha CEO of HST. “Visa Developer Platform provided us with straightforward integration and a speedy time to market."

Enhancing Mobile Wallets with Visa Capabilities through VDP

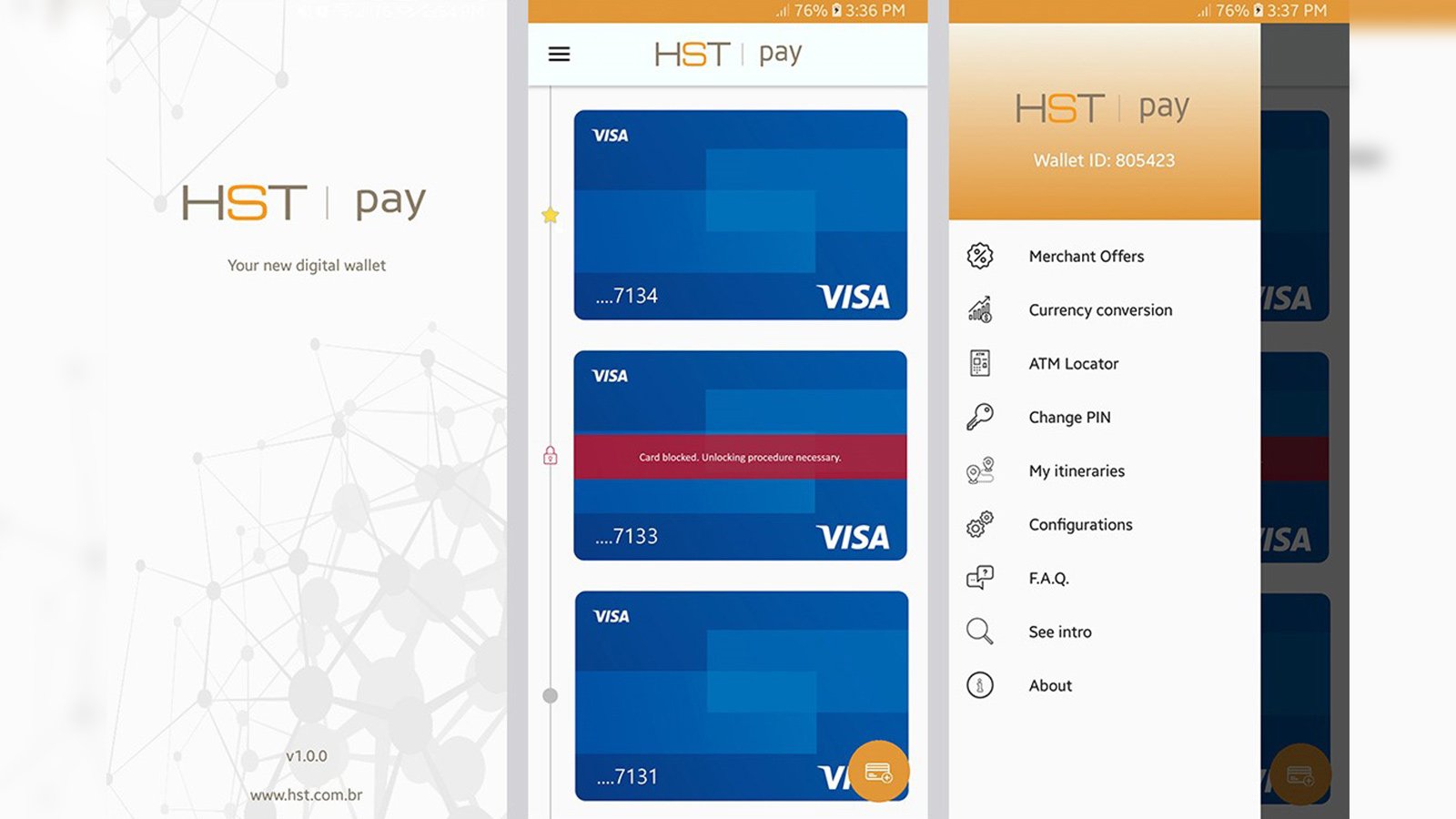

Among the solutions Visa and HST are enabling together are mobile wallets which allow issuing banks to avoid the set-up costs and headaches of building mobile wallets themselves. Providing a virtually turnkey solution, the digital wallets are integrated with Visa’s APIs providing value added features, another layer of convenience and innovation to the offering. When white-labeled, issuers need only customize with their logo, art and colors and the digital wallet can be issued under their own brand.

Visa API features integrated in the digital wallets include:

- ATM Locator – provides coordinates to find the nearest ATM

- Visa Merchant Offer Resource Center – issuers can offer clients specialized promotions, merchant offers including discounts or benefits

- Visa Travel Notification Service – consumers can alert Visa to travel plans and avoid declines in transactions due to travel

- Foreign Exchange Rate – currency converter tool

Visa Transaction Control – allows consumers to block and unblock card for any reason – misplaced cards, parental controls, etc. - without having to call their bank

Banks in Latin America are already taking advantage of the Visa HST digital wallets. BPP, Brazilian issuer, launched its issuer wallet in 2018 and Visa HST digital wallets are now also available through banks in Uruguay and Paraguay.

“We are commited to providing solutions to our customers that are meaningful, that make sense to them and are also fast to implement,” said Jose Coronel of BPP. “Our experience with Visa and HST provided us with just that and this is exactly the type of innovation we are looking for.”